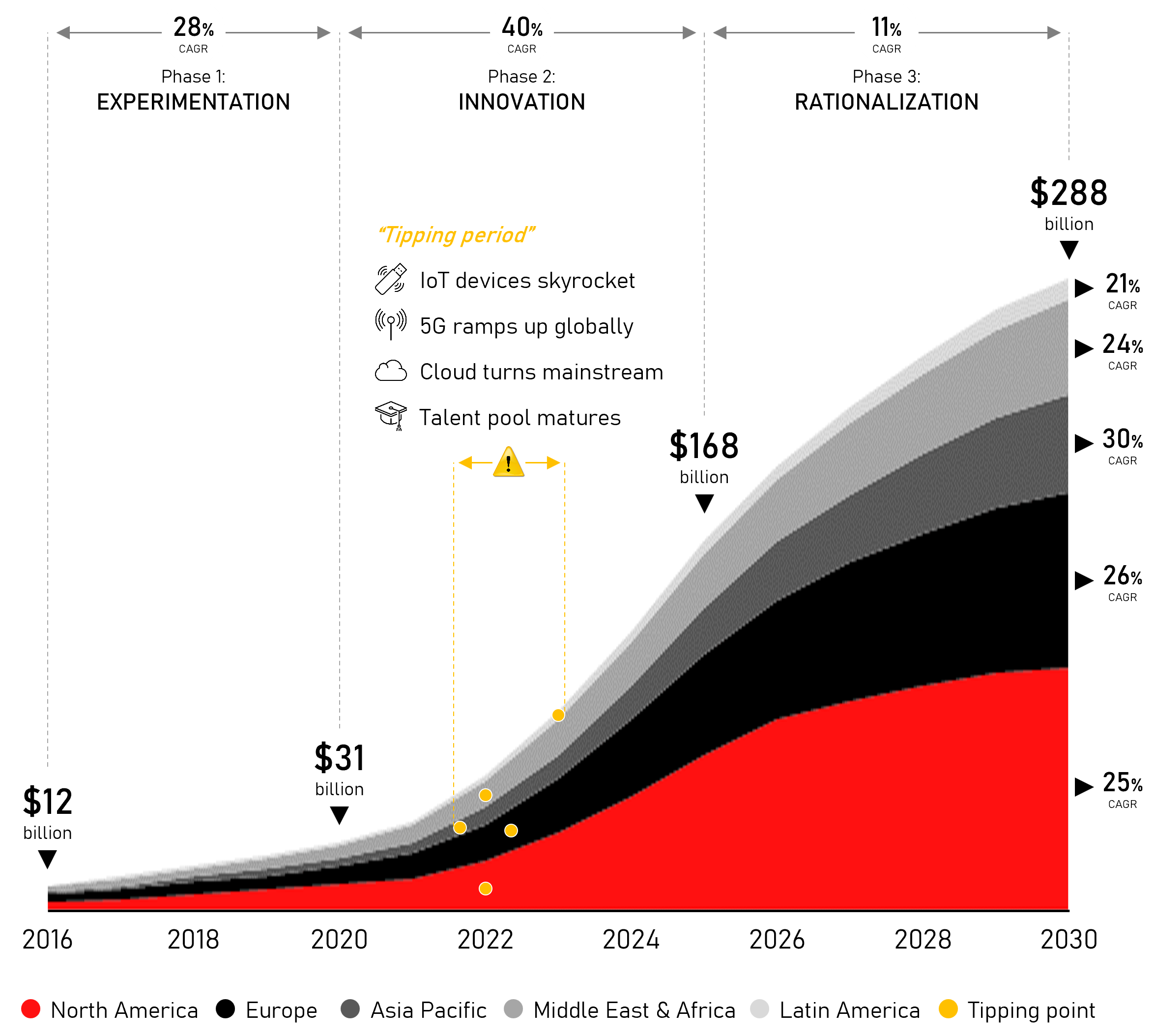

The global Artificial Intelligence market is expected to reach its tipping point soon.

Artificial Intelligence (AI) has been a buzzword in the world of business for a few years now. However, the industry surrounding this new technology has not yet managed to truly break through. With the arrival of 5G, the number of connected devices skyrocketing, cloud technology becoming mainstream, and the AI talent pool gradually maturing, that is about to change drastically.

In the next decade, the Artificial Intelligence market is expected to grow at an average of 25% per year, from $25 billion in 2019 to $288 billion in 2030. Approximately 40% of that demand will come from North America, while the highest growth is expected in the Asia-Pacific region. The latter is also projected to be the first region where the industry will hit its so-called tipping point, mainly influenced by nations such as China, Singapore, and Thailand.

In 2030, $55 billion is expected to be generated from AI services, while software and hardware are projected to account for $50 billion and $97 billion respectively – a split somewhat similar to today.

Own analysis inspired by data from Allied Market Research (2019), Ericsson Mobility Report (2019), Fortune Business Insight (2018), IDC (2019) and McKinsey & Co (2017)

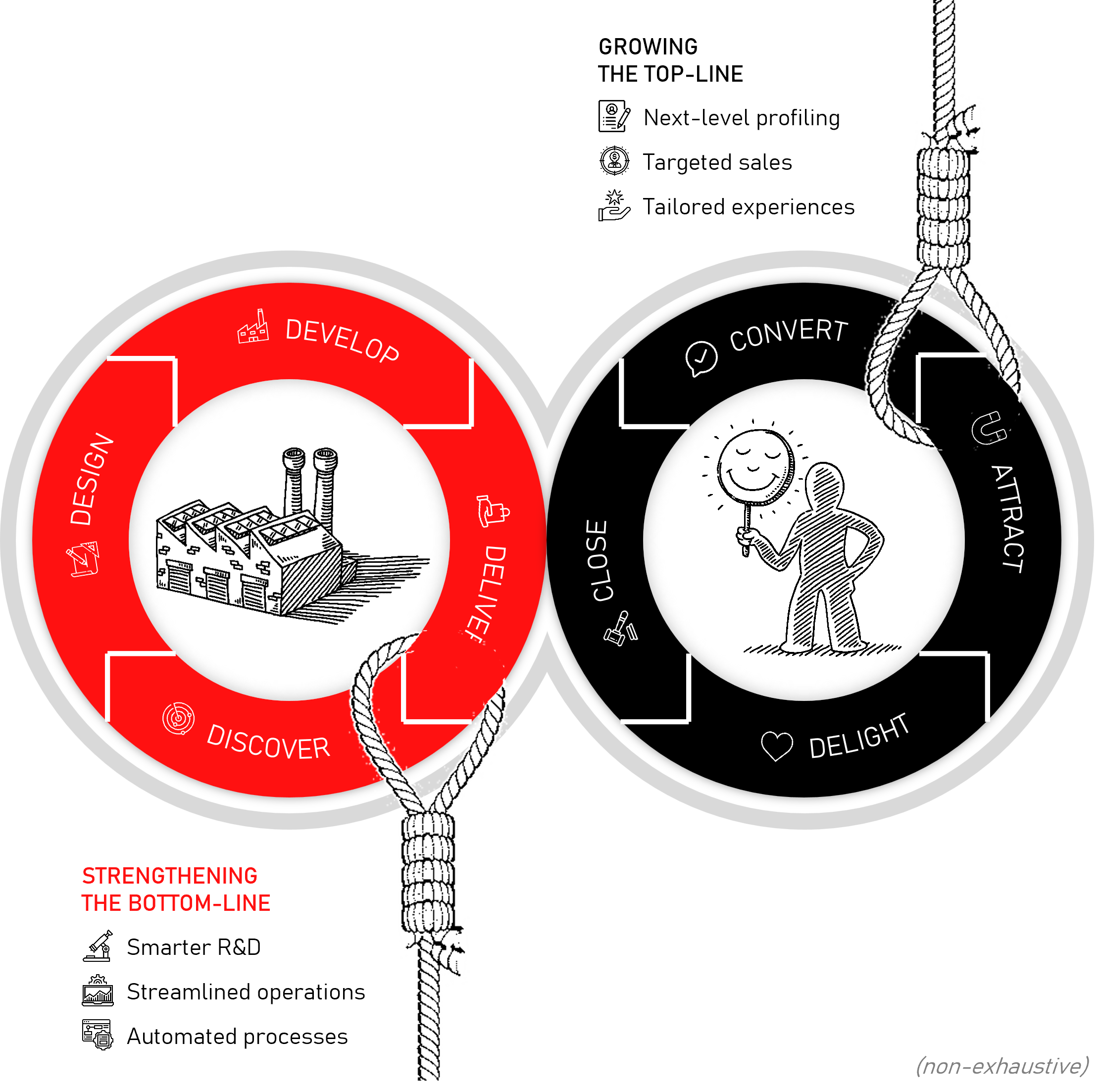

Its growth is fueled by our infinite expectations for this technology across the value chain.

Artificial Intelligence, or machines’ ability to think, work, and react like humans, comes with big promises. Indeed, a recent study by McKinsey estimates that AI has the potential to deliver additional global economic activity of around $13 trillion by 2030, while Accenture believes the technology can boost labor productivity by up to 40 percent in the next five years.

For most companies today, this promise translates into an opportunity to cut costs and strengthen their competitiveness. That is why many corporations are exploring how this technology can help them, for example, optimize or automate their production processes and become more efficient in their R&D activities.

Fortunately, there is also a growing number of companies that believe AI can aid in growing their top line. These businesses have understood that next-level profiling, targeted sales efforts, and fit-for-purpose products can enable them to offer their customers uniquely tailored experiences and truly stand out in the market.

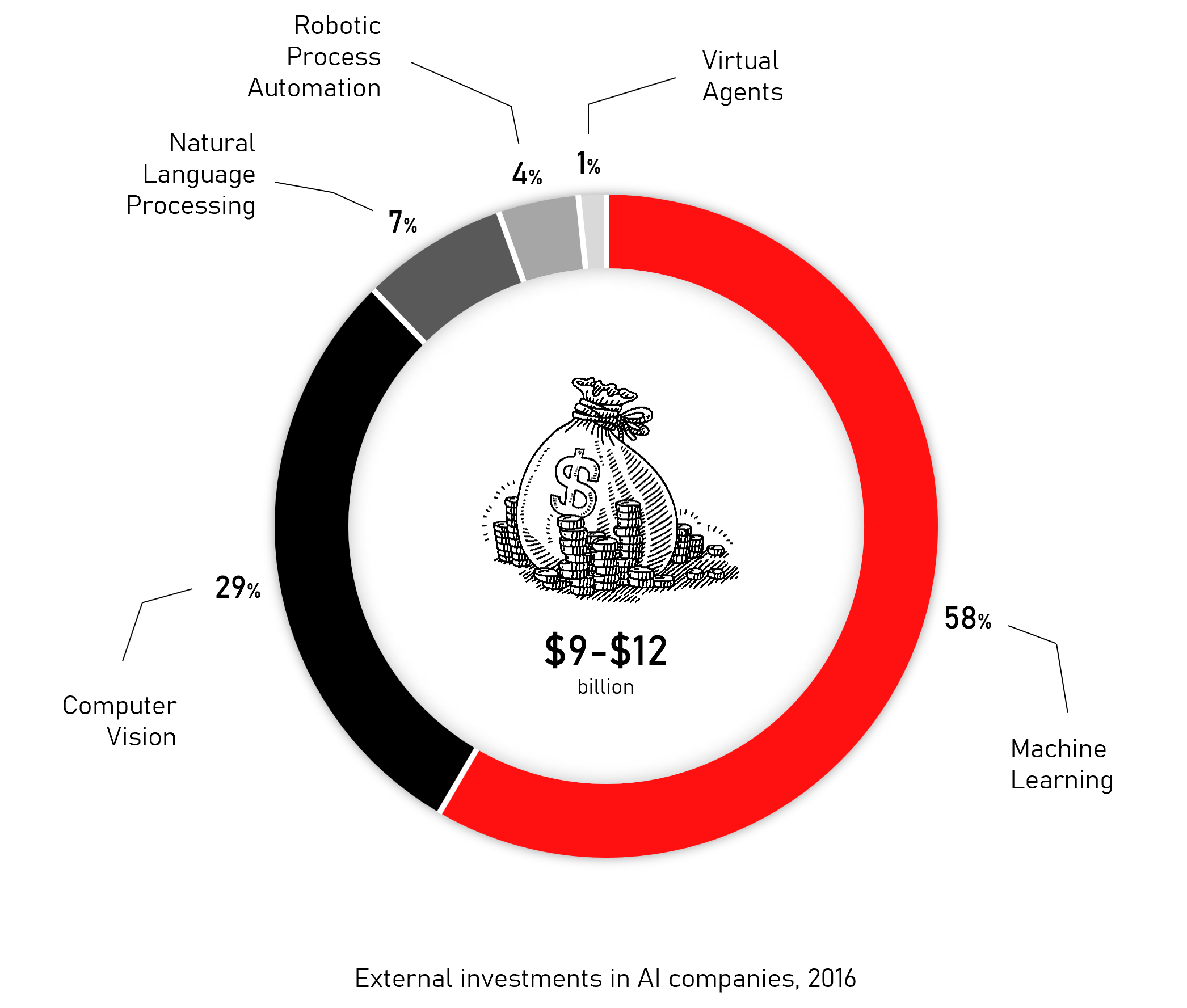

Recent investment trends suggest that Machine Learning will be the leading play.

Artificial Intelligence has many applications, most of which are powered by one or more of the technology’s sub-disciplines. The five most important disciplines are Machine Learning, Computer Vision, Natural Language Processing, Robotic Process Automation, and Virtual Agents.

At present, the most prevalent technology is Natural Language Processing (NLP), as it serves many essential applications, such as text parsing and speech processing, and powers man’s new best friends: Siri, Alexa, Cortana, and so on. As a result, NLP is estimated to account for about 40% of the total AI market today.

However, Computer Vision and, especially, Machine Learning are expected to become the leading plays in the future. In the next decade, Machine Learning’s promise to help companies streamline their operations will propel it to become the number one technology, accounting for more than 50% of the total AI market. Investors seem to share this belief as well, with approximately 60% of their recent investments being directed toward Machine Learning.

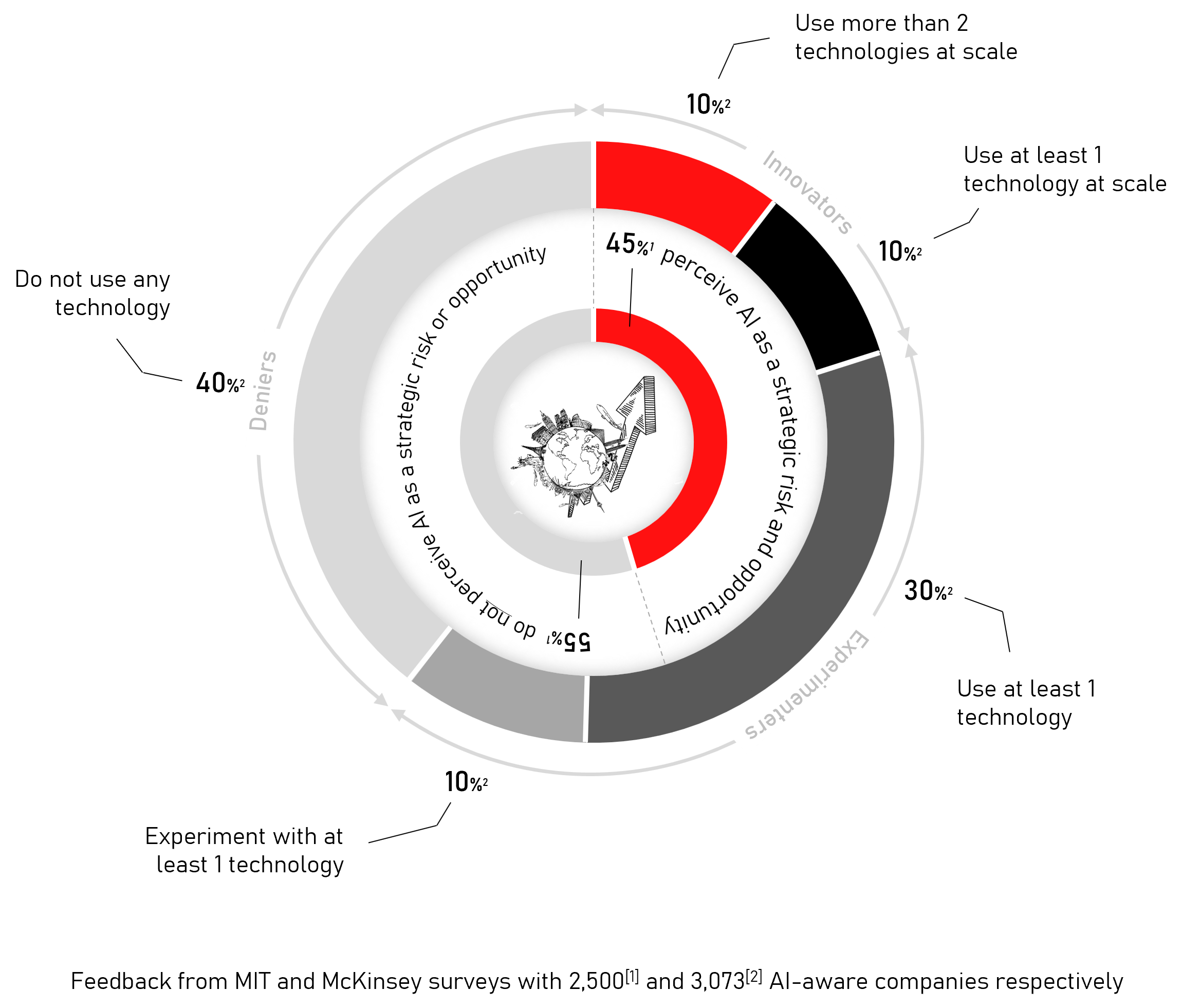

Surprisingly, AI’s current adoption in the world of business is (still) rather low.

Despite Artificial Intelligence’s big promise, companies are slow to adopt this new disruptive technology. Indeed, a recent survey by McKinsey of some 3,000 AI-aware corporations shows that only 20% have deployed at least one AI technology at scale, while about 40% are still contemplating this new reality.

A 2019 report from MIT Sloan, in collaboration with BCG, provides some reasons for this poor adoption. First, it shows that 55% of companies still do not perceive Artificial Intelligence as a strategic opportunity or threat. Secondly, it turns out that many AI initiatives fail, resulting in 40% of organizations making zero business gains from their investments in this new technology.

These poor returns on investment obviously do not inspire the 40% of contemplators to act, nor the 40% of experimenters to bring their initiatives to the next level. However, it must be said that the root cause of these weak returns is typically not the technology itself, but rather companies’ inability to industrialize their proofs of concept.

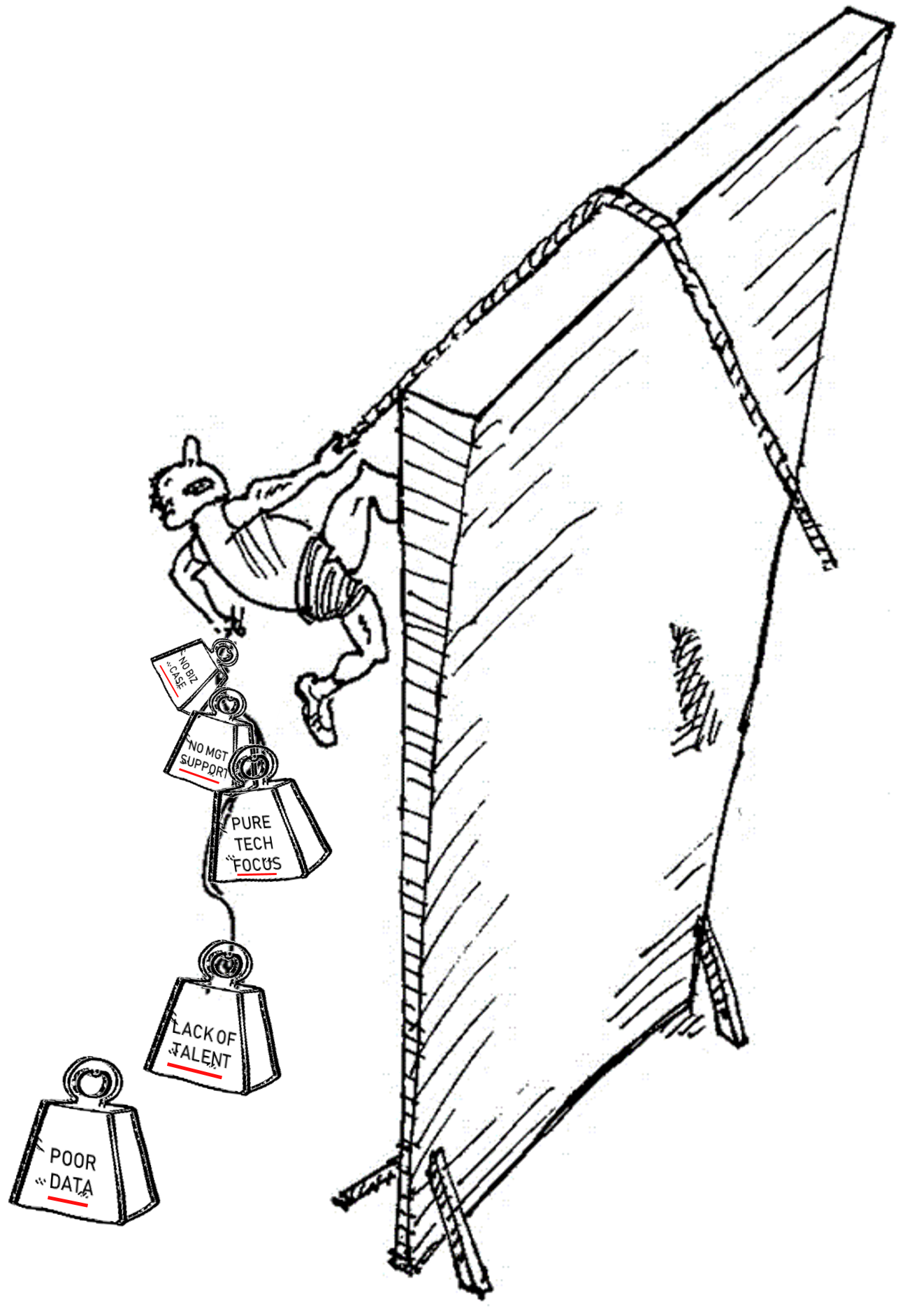

This poor adoption can be explained by the many hurdles firms need to overcome.

Companies’ current inability to capture true value from AI stems from the fact that they typically have a hard time overcoming five key challenges. Indeed, most corporations:

- Struggle to attract the necessary experts who know how to work with AI and how to put it to real use for the business.

- Lack the necessary data to start their journey and suffer from errors or bias in their data, which may compromise their work.

- Fail to define an attractive business case, as the revenue and cost savings potential are hard to quantify, while the costs for development and operations remain high.

- Spend too much focus on the technology itself but fail to realize the organizational implications that come with embracing AI.

- Do not get enough senior management support, which is pivotal to generate the necessary momentum to overcome organizational inertia.

A recent MIT study suggests a way forward, unveiling how firms can effectively embrace AI.

In its 2019 Artificial Intelligence Research Report, MIT finds that companies winning with AI exhibit five distinct organizational traits. These organizations:

- Integrate their AI strategies with their core business strategy, realizing that AI is merely an enabler and not an end in itself.

- Take on large AI efforts that prioritize revenue growth over cost reduction, considering AI mainly as a means to stand out.

- Align the production of AI with its consumption, having their business, IT, and R&D teams work together to develop solutions that are feasible, scalable, viable, and most of all, desirable.

- Unify their Artificial Intelligence initiatives with their larger business transformation efforts.

- Invest in AI talent, data, and process change in addition to the technology itself, realizing that embracing AI is not just a technology play, but requires new ways of working as well.

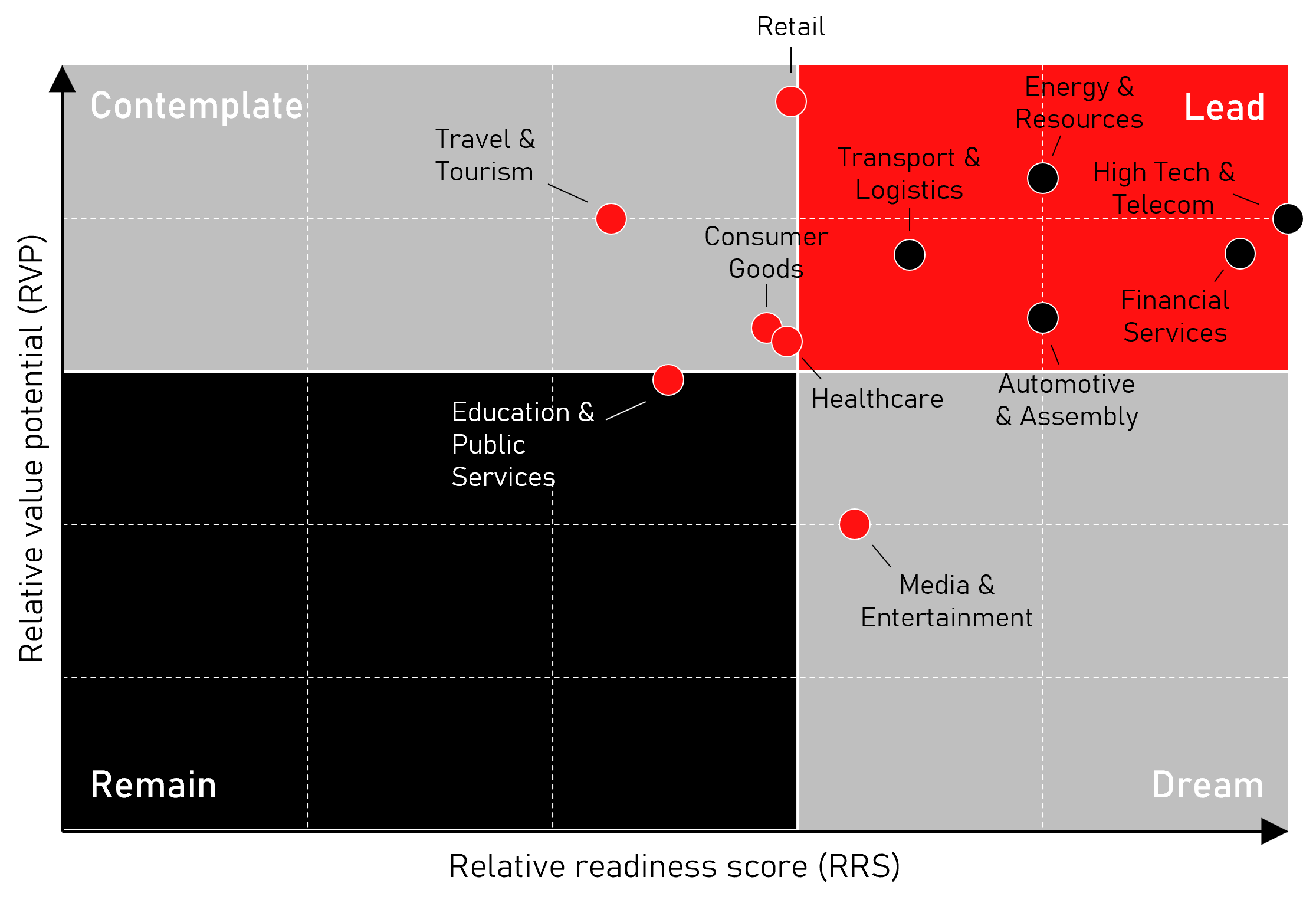

Digitized industries show a higher readiness and eagerness to take advantage of AI.

Research from the McKinsey Global Institute demonstrates that industries on the digital frontier are also readier to adopt Artificial Intelligence. Adding the technology’s value potential for each industry to the equation, we see that five sectors are leading the pack: High Tech & Telecom, Financial Services, Energy & Resources, Automotive & Assembly, and Transport & Logistics.

At the same time, it seems that there are two industries significantly underinvesting in this new technology. Indeed, the promise of AI for the Travel and Retail sectors is huge, and with customers demanding ever more unique experiences and industry rivalry intensifying, the time to act is now. If not, players in these industries risk losing profits or, worse, becoming irrelevant.

The Media & Entertainment sector, on the other hand, may be betting too much on Artificial Intelligence at this very moment. Their current investments in this new technology are seemingly high compared to the added value AI is expected to bring to their businesses and customers.

Own analysis inspired by data from McKinsey & Co (2018)

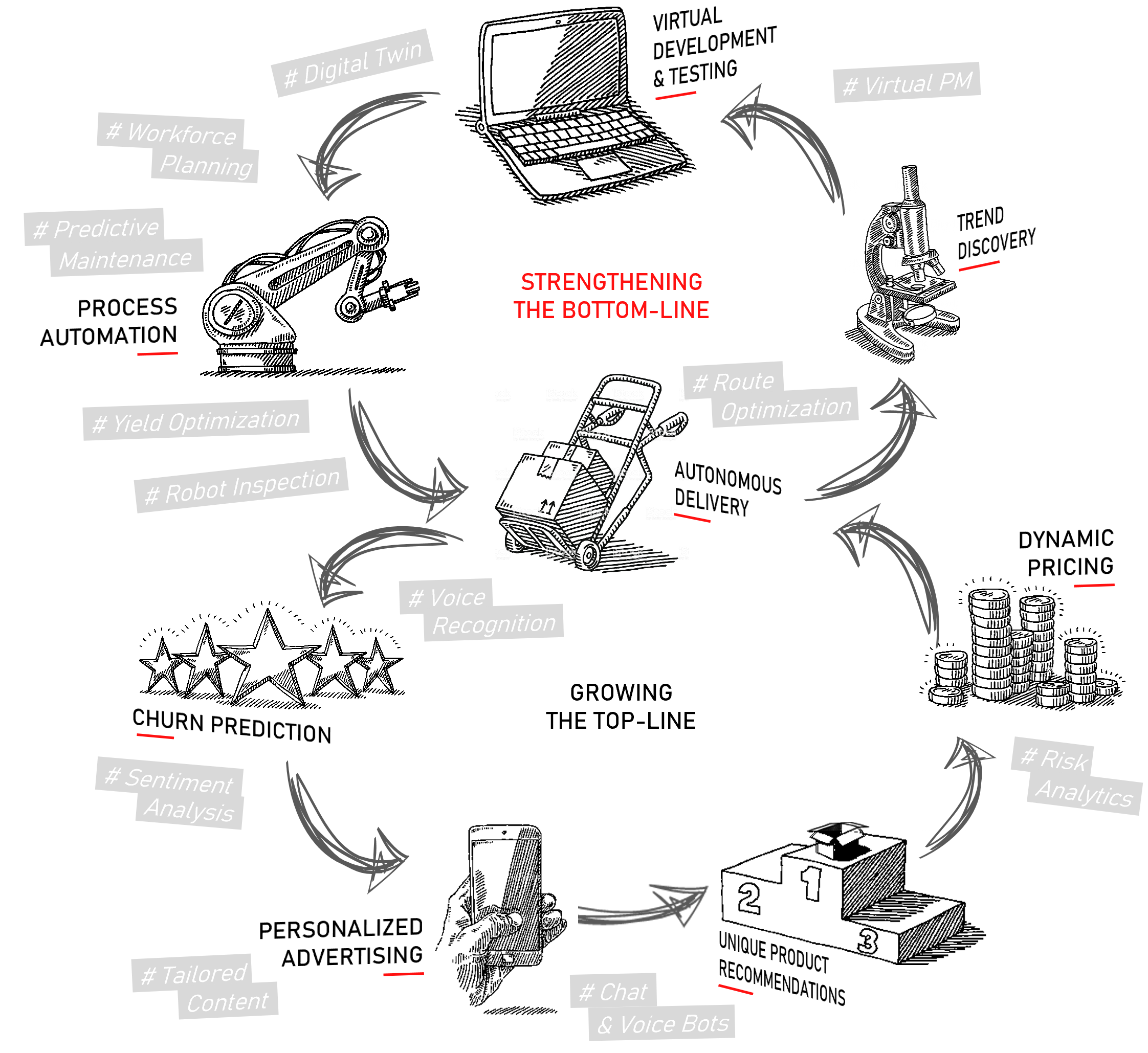

Smart use cases will foster adoption and pave the way for AI’s exponential growth.

As companies around the world gain more knowledge about Artificial Intelligence, the most impactful use cases powered by this new technology are becoming clearer too. And although no two companies are the same, there is a growing consensus that many use cases, especially those in the fields of Sales & Marketing and Operations, are quite universal.

Some of the most anticipated use cases include:

- Virtual product development and testing in R&D.

- Process automation and predictive maintenance in Operations.

- Personalized content and customer support in Marketing.

- Risk analytics and fraud detection in Risk & Compliance.

With the surrounding context growing ever more favorable, and by adhering to MIT’s five recommendations, companies around the world will soon be able to not only develop but also industrialize these use cases. This will unleash AI’s true power and propel it to become the $288 billion industry it is expected to be by 2030.